Lab diamonds, also known as synthetic or cultivated diamonds, are a type of diamond that has been created in a laboratory. Unlike mined diamonds, which are formed naturally over thousands of years under immense pressure and heat deep within the Earth’s crust, lab diamonds are created using modern technologies in weeks.

Lab-grown diamonds have long been considered inferior to mined diamonds due to their lower cost and perceived lack of quality. However, with advancements in technology, this perception is changing drastically. Lab-grown diamonds have the same chemical composition and physical properties as natural diamonds; they are made up of pure carbon atoms arranged in an isometric lattice structure – the only difference being that Mother Nature herself did not form them. Lab-grown diamond jewelry can be so similar to its natural counterparts that it requires special equipment for identification.

Creating lab-grown diamonds starts with a diamond seed in an environment called a “diamond growth chamber,” where temperatures can reach nearly 1100° Celsius (2012° Fahrenheit). During growth, gases such as methane or hydrogen are added to the chamber and heated until they decompose into tiny molecules consisting primarily of carbon atoms. These molecules then settle onto the surface of the diamond seed and eventually form into a firmly bonded crystal structure composed entirely of carbon atoms – thus producing a ‘cultivated’ diamond.

Lab-grown diamonds are created in a laboratory by reproducing the same chemical and physical properties as natural diamond crystals. Scientists can replicate this process by recreating the Earth’s mantle’s high pressures and temperatures or using advanced technologies such as Chemical Vapour Disposition (CVD) and High-Pressure High Temperature (HPHT). As a result, these lab-grown gems have the same visual characteristics, light performance, brilliance, and clarity as a mined diamond but often at a much more accessible price point.

Using lab-grown diamonds has several environmental benefits over mined diamonds: reducing energy consumption during production due to avoiding mining processes; reducing waste products; lower pollution levels; and fewer emissions resulting from transport costs associated with shipping mined stones worldwide. Furthermore – because no mining is involved – there’s no risk of human rights abuses associated with unethical labor practices for sourcing natural rocks.

Do Lab-Grown Diamonds Hold Their Value?

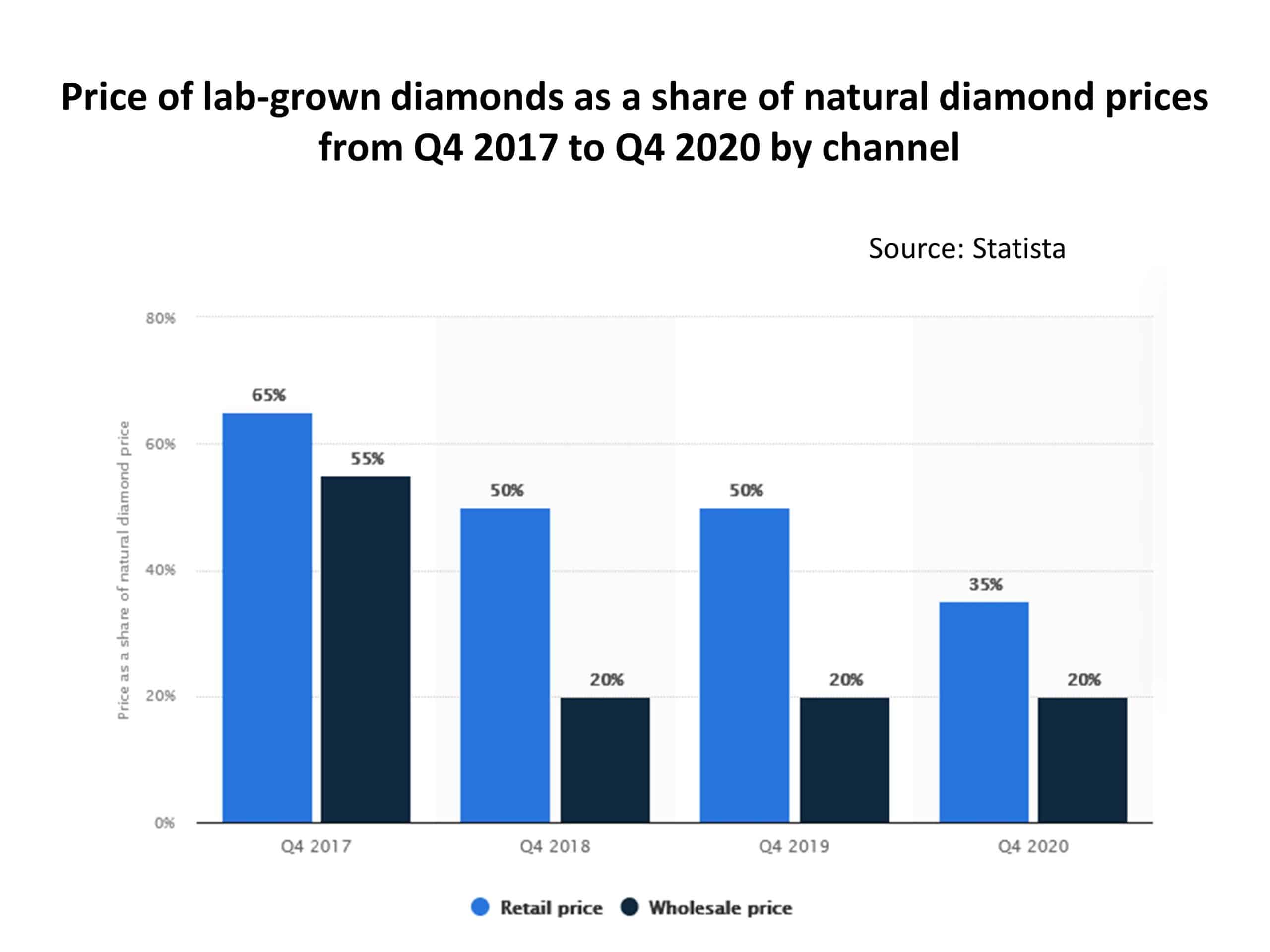

No, Lab-grown Diamonds do not hold their value because their price can significantly drop after purchase compared to natural diamond prices. Every year, lab-grown diamond production increases compared to natural diamonds, which are scarce and unique gifts from nature.

Based on the research “Lab-grown diamond price in proportion to natural diamonds by channel Q4 2017-Q4 2020” by M. Garside, we can see that price as a share of natural diamond price was 65% for the retail industry in 2017., while in 2020 was only 35%.

One of the most critical impacts on diamond price is CT TW.

Price points for lab-grown diamonds are usually 20-80% lower than those of naturally occurring stones, which seems attractive to some consumers looking for an affordable diamond option. However, it’s important to note that because lab-created diamonds are abundant on the market with increasing production yearly, prices for these stones can significantly decrease after purchase compared to natural diamond prices, which remain reasonably stable due to scarcity. When reselling your lab diamond, you may not get back what you originally paid.

One way to protect yourself from devaluation is to obtain a certification from a reputable laboratory such as GIA or IGI that grades your stone on its 4Cs (color, cut, clarity, and carat weight). A written appraisal also helps ensure that you receive total value when selling your stone in the future. Additionally, when shopping for your lab-grown diamond, look for gemstones with excellent proportions and symmetry; these elements help maximize the sparkle factor, so you get more bang for your buck!

In conclusion, while it’s true that prices for lab-grown diamonds are much more appealing than natural stones due to their abundance in the marketplace – they don’t always hold their value as mined diamonds do. Therefore, extra caution should be taken when purchasing one – ensure you get all the necessary certifications and opt for stones with excellent proportions and symmetry!

So why should you choose lab-grown diamonds? For one, they offer exceptional value for money – typically costing much less than their natural counterparts while still providing buyers with a beautiful stone containing all the qualities found in mined versions. Secondly – because they have been ethically produced – you no longer need to worry about contributing to harmful environmental practices or unethical activities when buying your next piece of jewelry!

Lab-grown diamonds have gained immense popularity over the past few years due to their ethical and sustainable production and affordability. While they’re physically and chemically identical to mined diamonds, many wonder if they keep their value over time. The short answer is no; lab-grown diamonds do not typically hold their value like natural diamonds.

To learn more about diamonds, please read our articles:

Do Lab-Grown Diamonds Hold Their Value?

How to Tell How Many Carats a Diamond Is?

How Much is 1 Carat Diamond Worth?

How Much is a 3-Carat Diamond Ring?