Diamonds have always been a symbol of luxury, status, and wealth. This gemstone has had a unique place in our society for centuries, and its value has only grown over time. Diamonds are believed to hold their value because their prices increase drastically every ten years.

This remarkable growth in price is due to several factors, like the gemstone’s limited availability combined with increasing demand due to changing consumer habits, making diamonds a precious commodity. Other influencing factors include conflict diamonds, which have created a scarcity of specific diamonds, and governments taxing mined diamonds. This means that diamonds are much harder to come by now than they used to be, and investing in them can be seen as a wise financial move.

When people think about buying jewelry or other items made from diamonds, they should consider the fact that these gems hold their value over time. This means that if you purchase something with diamonds, it will only increase in price over time, unlike many other commodities, which fluctuate wildly depending on market conditions.

For those looking for alternative investments besides stocks or real estate, diamond investments could be worth considering, given their long-term potential for growth. While some risks are associated with this type of investment – such as theft or damage – these risks can be mitigated with proper insurance coverage or other security measures depending on how much money you’re willing to spend on your investment.

Many people also opt to buy loose uncut diamonds to get the most out of their investment since they tend to appreciate faster than already processed stones like necklaces or earrings might; however, this requires special knowledge, so it is not recommended unless you know what you’re doing and understand the nuances involved with diamond grading systems and pricing structures across different markets around the world.

Overall, diamond investments remain an attractive option for those looking for long-term returns on their capital. With proper research and luck, investors could enjoy substantial returns from this timeless asset class, which continues to appreciate despite fluctuations in key macroeconomic indicators such as inflation and currency values.

So, do diamonds appreciate value with age?

Do Diamonds Hold Their Value?

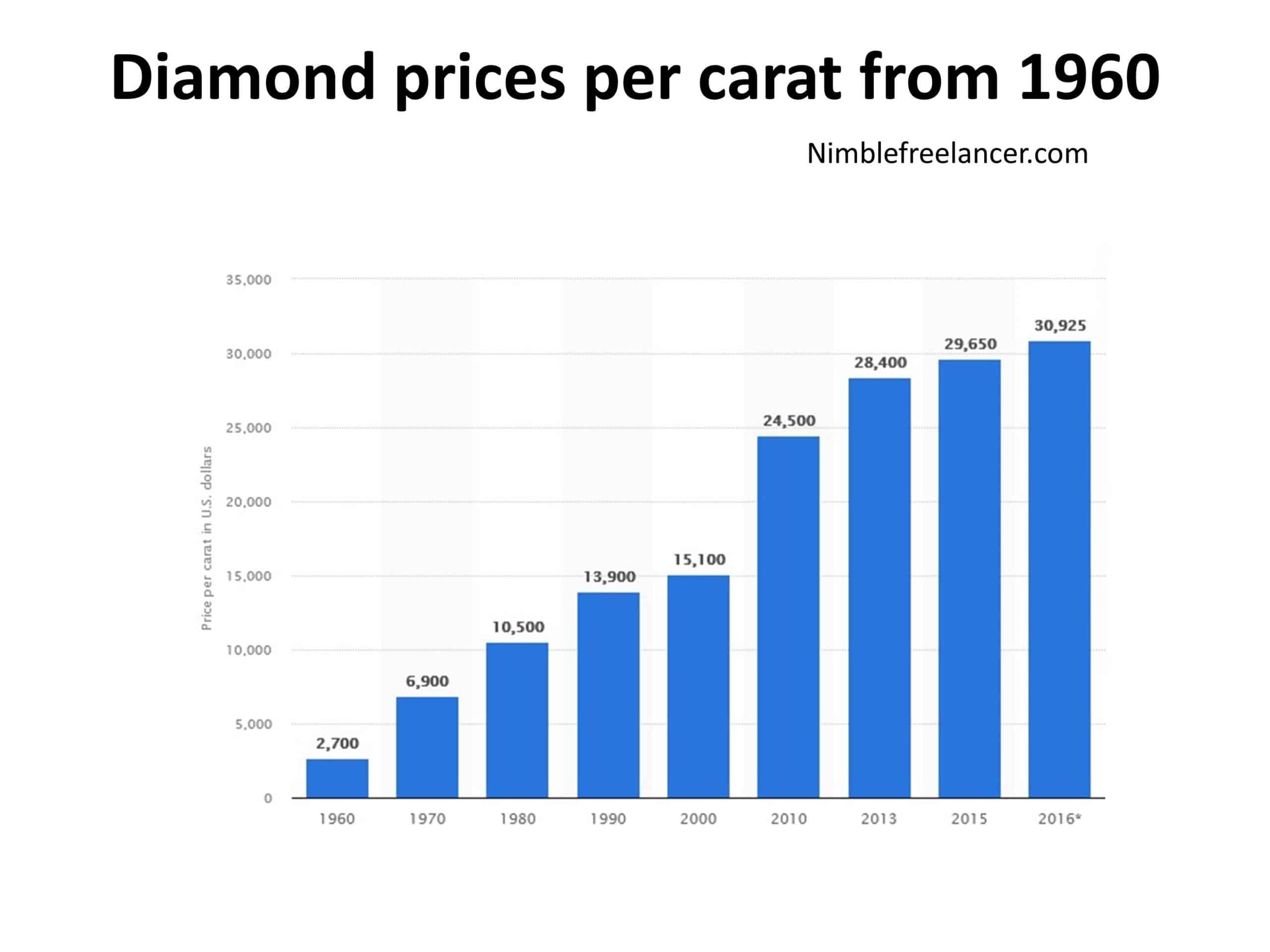

Diamonds hold their value because the price increases from 40% to 87% every ten years. For example, diamonds were worth in 1960. was $2700, while ten years later, in 1970 was $6900. Additionally, in 2000, the price for 1 carat was $15100, while ten years after $24500.

The price of diamonds has been increasing steadily for the past few decades. Recently, we showed a 3-carat diamond worth. Here are some specific examples of 1-carat diamonds worth over a long span of years:

-In 1960, the average price for a 1-carat diamond was $2700. Ten years later, in 1970, the same diamond would be worth $6900.

-In 2000, the average price for a 1-carat diamond was $15100. Ten years later, in 2010, the same diamond would be worth $24500.

Let us analyze the previous chart:

- From 1960 up to 1970. we had an 87.5% increase in diamond price.

- From 1970 up to 1980. we had a 41.3% increase in diamond price.

- From 1980 up to 1990. we had a 27.8% increase in diamond price.

- From 1990 up to 2000. we had an 8.27% increase in diamond price.

- From 2000 up to 2010. we had a 47.47% increase in diamond price.

There are a few reasons why diamonds continue to go up in value:

- Supply and demand. There is a limited supply of diamonds worldwide, while the global market continues to increase (especially from China and India). This imbalance between supply and demand is what drives prices higher.

- Durability. Diamonds are one of the most complex substances on earth and will last indefinitely with proper care. This makes them much more valuable than other precious stones, which are more fragile and have shorter lifespans.

- Versatility. Diamonds can be used in various jewelry designs and are famous for industrial purposes (such as drill bits and saw blades). This versatility gives them a greater appeal and, hence, a higher value.

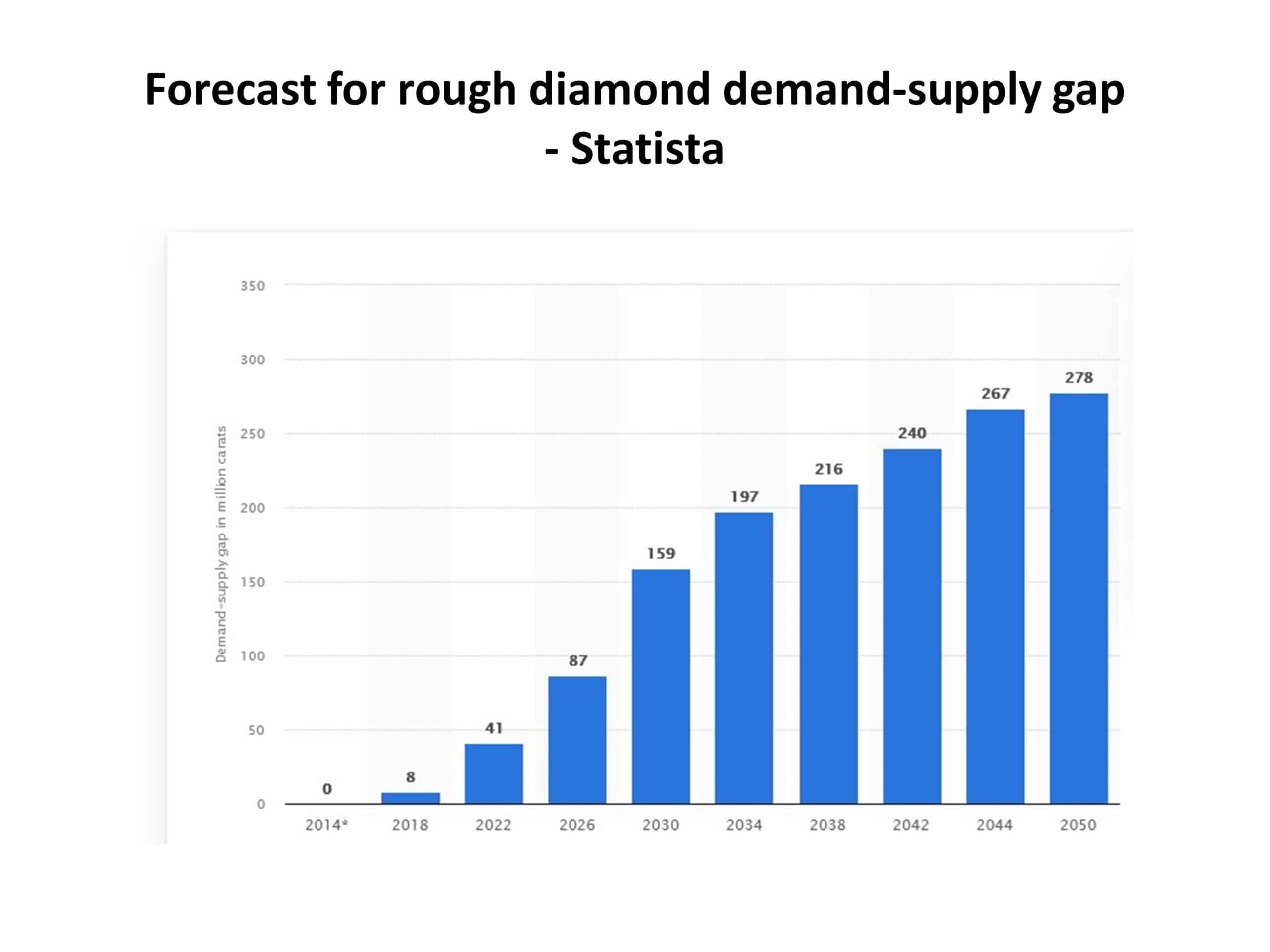

According to Statista’s research, there is a massive gap between demand and supply for diamond production. Statista research shows prediction where we can see low supply in the following decades:

High demand, low supply – this can lead only to a diamond price increase!!!

To learn more about diamonds, please read our articles:

Do Lab-Grown Diamonds Hold Their Value?

How to Tell How Many Carats a Diamond Is?

How Much is 1 Carat Diamond Worth?

How Much is a 3-Carat Diamond Ring?

How Many Carats is the Hope Diamond?

What does 1/10 CT TW Diamond Mean?